Your pension savings might seem distant from rainforests, but every pound invested can either accelerate forest destruction or nurture global ecosystems. Understanding how your retirement fund links to deforestation empowers you to demand change and safeguard our planet.

How Pension Investments Drive Forest Loss

Across the UK, more than £300 billion of pension fund investments are tied to businesses with high deforestation risk. In typical schemes, nearly a third of public equity and corporate bond holdings fuel industries like beef, soy, and palm oil production—major drivers of forest clearance in the Amazon, Indonesia, and beyond.

Major asset managers in the US, including giants such as BlackRock and Vanguard, continue to purchase corporate bonds for companies directly linked to forest loss. Through these investments, pension funds inadvertently underwrite supply chains that clear millions of hectares of tropical forest each year.

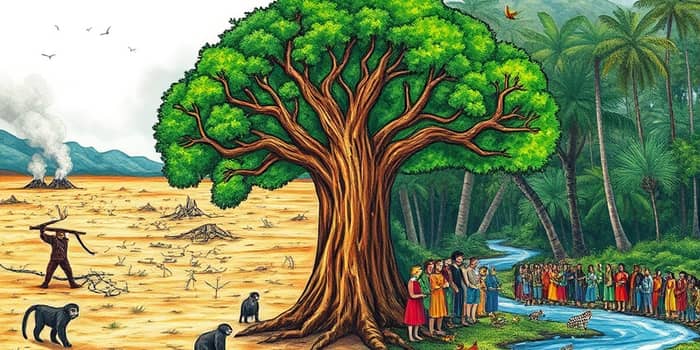

Why Forests Matter for Climate and Biodiversity

Forests are the planet’s lungs, sequestering carbon and regulating weather systems. When trees fall, vast stores of carbon enter the atmosphere, making it harder to meet Paris climate targets.

Tropical woodlands host 80% of terrestrial biodiversity and sustain the livelihoods of 1.6 billion people. Forest loss triggers species extinction, soil erosion, and economic hardship for Indigenous and rural communities.

Risks and Reactions of Savers

Consumer sentiment is shifting. Surveys show 77% of UK pension holders would be unhappy if their savings financed forest destruction. Over a quarter say they would switch providers, and millions might cut contributions rather than support deforestation-linked investments.

Beyond ethics, these assets carry growing financial risks. Regulatory crackdowns, reputational damage, and shifting consumer preferences can erode returns on ventures that undermine environmental goals.

Paths to Stop Deforestation

- Change investment mandates: Pension funds can divest from high-risk sectors and adopt net-zero commitments with clear deforestation-free criteria.

- Support Indigenous land rights: Investing in projects that secure legal recognition of territories has proven to reduce forest loss most effectively.

- Promote certification programs: Backing supply chain initiatives for sustainably sourced beef, soy, and palm oil limits deforestation and rewards responsible producers.

- Advocacy and petitions: Savers can urge trustees to adopt zero-deforestation mandates through member resolutions or open letters.

- Demand full transparency: Calling for clear reporting on holdings and environmental impact helps pinpoint deforestation links in complex supply chains.

- Choose deforestation-free funds: Where available, switch to ESG-focused pension schemes with verifiable commitments against forest destruction.

Overcoming Challenges with Data and Policy

Complex global supply chains often lack detailed traceability, making it hard to identify exactly where deforestation occurs. Improved satellite monitoring, blockchain tracking, and public databases can strengthen accountability.

International frameworks like the Kunming-Montreal Global Biodiversity Framework encourage integrating nature and Indigenous rights into financial decisions. These policies set benchmarks that retirement funds can use to guide sustainable investments.

Success Stories and Emerging Trends

- In Kenya, carbon credit programs offer local communities health and education benefits in exchange for protecting forests, reducing land clearance dramatically.

- Certification schemes for coffee and palm oil in Southeast Asia have cut deforestation rates where robustly enforced by third parties.

- Investor activism has pressured several large pension funds to disclose deforestation exposures and set timebound targets for divestment.

Conclusion: Your Role in the Forest’s Future

Every saver wields influence. By demanding responsible investment policies and choosing funds that prioritize forest protection, you can transform your retirement savings into a powerful force for planetary health.

Now is the moment to hold pension managers accountable, advocate for transparency, and support solutions that halt deforestation. Together, we can ensure that our financial futures and the future of Earth’s forests remain intertwined—and flourishing.

References

- https://globalcanopy.org/insights/explainer/how-are-pensions-and-deforestation-linked/

- https://www.globalwitness.org/en/campaigns/forests/esg-funds-funnel-millions-deforestation-risk-company/

- https://forest500.org/blog/2023/11/27/more-half-welsh-public-pension-investments-risk-financing-deforestation/

- https://pensionsage.com/pa/Over-300bn-of-UK-pension-money-linked-to-deforestation.php

- https://sustainablebrands.com/read/pension-funds-committed-net-zero-not-seeing-forest-for-trees

- https://www.conservation.org/blog/what-drives-deforestation-and-how-can-we-stop-it